From 5/9/12 to 5/24/12

JRH 5/24/12

__________________

Fed approves Chinese bank purchase of US bank

From Tony Newbill

Sent: 5/9/2012 2:50 PM

Will this be the End of the Dollar by opening up trade of the Gold backed Yuan in the USA in direct competition with the Government backed Dollar?

+++++++++++++++++++

This is why we are Screwed!!!!!!

From Tony Newbill

Sent: 5/19/2012 4:29 PM

This is why we are Screwed!!!!!!

http://en.wikipedia.org/wiki/Tariff_Act_of_1789 .... we became Dependent when we should Be Independent at a balanced rate of domestic supply production.

This is the result of the SERFDOM of our trade policy Insolvency......

The Final Turning

A Presentation by MoneyNews and Newsmax

“This Wasn’t An Accident”

Newt Gingrich, Lou Dobbs, Larry Kudlow, John Bolton, Dick Morris and other Champions of Freedom Have Come Together to Reveal the Truth.

Hear Their Testimony. See the Evidence. Prepare for the Unthinkable!

[SlantRight Editor: To View Video Click Newsmax Link. The bottom line of the video is a sales pitch.]

The unit at the center of JPMorgan Chase & Co.'s recently revealed $2 billion trading loss has built up more than $100 billion in positions in asset-backed securities and structured products, the Financial Times said.

The newspaper said this portfolio comprises the "complex, risky bonds at the center of the financial crisis in 2008," but did not say whether any of the holdings are in unhedged positions.

It said the portfolio is separate from holdings in credit derivatives that led to the trading loss by JPMorgan's chief investment office, which has sparked much criticism of the largest U.S. bank and its chief executive, Jamie Dimon.

JPMorgan spokeswoman Kristin Lemkau declined immediate comment. (Read more)

The newspaper said this portfolio comprises the "complex, risky bonds at the center of the financial crisis in 2008," but did not say whether any of the holdings are in unhedged positions.

It said the portfolio is separate from holdings in credit derivatives that led to the trading loss by JPMorgan's chief investment office, which has sparked much criticism of the largest U.S. bank and its chief executive, Jamie Dimon.

JPMorgan spokeswoman Kristin Lemkau declined immediate comment. (Read more)

++++++++++++++++++++++++++++

Putting it all together , this could be the economic false flag even .....

The Recovery Is an Illusion

[SlantRight Editor: There are several graphs/charts for you econ minded people in this link. I am excerpting a portion below the graphs/charts.]

The Fed may call it something else, because QE3 will not play well politically to announce the infusion of a couple of trillion dollars into the banking system. The Fed will say it is necessary to stimulate a slowing economy.

This is a very dangerous situation, one that eventually will lead to a massive decline in the U.S. dollar. Global confidence has been lost in the dollar. I think the Fed's next action will trigger renewed dollar selling, leading to dollar inflation, which is already starting to accelerate. Weakness in the dollar tends to spike oil prices, a big factor behind domestic inflation.

We have been having inflation in a weak economy. Instead of being driven by strong demand—which is a relatively happy circumstance for having inflation—inflation today has been created by a weak dollar and unstable monetary policy by the Fed. That is not a happy circumstance. It is a circumstance that promises much higher inflation as people look at preserving their assets.

TGR: The federal government has been reporting inflation between 2% to 3%. You just updated your 2012 hyperinflation report. What is real inflation right now?

JW: The government's numbers are accurate by its definition, but they are not what people think they are. Over the years, the methodologies have changed.

The average person thinks that the Consumer Price Index (CPI) measures inflation, that it reflects the cost of maintaining a constant standard of living. They also believe that it reflects out-of-pocket inflation. It does not, nor does it reflect the cost of maintaining a constant standard of living.

After World War II, the CPI was used to measure the cost of inflation for a fixed basket of goods and services. For example the basket of goods might contain a gallon of gas, a pound of steak and a loaf of bread. The government would measure the same, year after year. However much the price had gone up, that was how much inflation had gone up.

In the 1990s, Fed Chairman Alan Greenspan and Michael Boskin, then chairman of the Council of Economic Advisors, started pushing the story that the CPI was overstating inflation. They figured that adjusting the CPI reporting would reduce the Social Security cost-of-living adjustments. That is why they did it. If they had not changed the CPI, Social Security checks would be about double what they are today.

But at the same time, they introduced a substitution that made the CPI worthless for anyone trying to use it as a target for calculating, for example, what their minimum return on investment should be in order to maintain their standard of living.

If you use an inflation rate that is too low, you get a too-strong inflation growth. You see recovery that is not there, which is what we've been seeing. (Read Entirety)

+++++++++++++++++++++

This is How the US Government and the federal Reserve are Containing Inflation

Sent by Tony Newbill

Sent: 5/24/2012 11:14 AM

This is How the US Government and the federal Reserve are Containing Inflation, but it will unleash Hyper Inflation event that will over night collapse the Free Markets Once the Federal Reserve action is rejected by foreign Suppliers of the BRIC Nations!!!

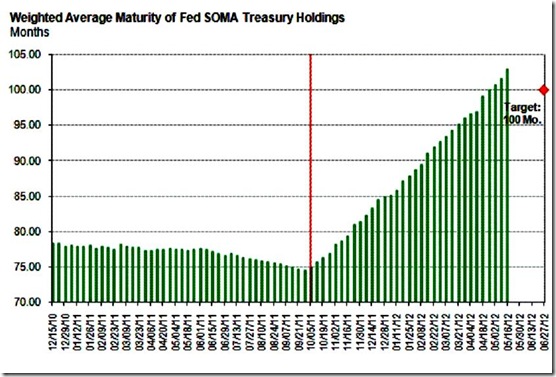

By The Time Operation Twist 1 Is Over, The Fed Will Have Quietly Completed 40% Of Operation Twist 2 As Well

Submitted by Tyler Durden

05/20/2012 21:36 -0400

Zero Hedge

By the time Operation Twist (1) ends in just over 40 days time, on June 30, Fed Chairman Ben Bernanke, according to his previously announced "loose" target, will hope to have extended the average maturity of all bonds in the System Open Market Account (SOMA) to a record of roughly 100 months from 75 month at the onset of the program in October 2011. After all the sole purpose of Twist was to load up the Fed's portfolio with duration, forcing the rest of the market to shift its investing curve even further into risky assets, as the Fed will have effectively onboarded the bulk of securities in the 3-4% return interval. Now as we showed back in early April, hopes that the Fed will simply continue with Operation Twist 2 after the end of "season" 1, as suggested by some clueless "access journalists" who merely relay what they are told by higher powers, are completely misguided as the Fed simply does not have enough short-term securities (1-3 years) to sell, and would have at most 2 months of inventory for a continued sterilized operation. Which however, does not mean that the Fed can not be quietly ramping up its operations in the ongoing Twisting episode. Because as Stone McCarthy demonstrates, as of the past week, the Fed has already surpassed its 100 month maturity target of 100 months, and is at 102.82 months as of May 16. And this is with 6 more weeks of Twist to go: at the current rate of SOMA purchases, the Fed will have a total portfolio average maturity of just shy of 110 months by June 30! Which means that contrary to market expectations of what the Fed's own stated goal may have been, Bernanke will have gobbled up nearly 40% more long-dated Flow relative to estimates! In other words, Ben does not need to do a full blown Operation Twist 2 episode: by the time Twist 1 is over, he will have attained nearly 40% of the goals of the next potential sterilized operation.

Why is this important? Well, recall that over a month ago Goldman Sachs itself admitted what we have been saying for over 3 years: it is not stock that matters... it is flow. Recall the Goldman punchline:

...we have found some evidence that at the very long end of the yield curve, where Operation Twist is concentrated, it may be not just the stock of securities held by the Fed but also the ongoing flow of purchases that matters for yields...

And there you have it.

What the finding above means is that the Fed has been ramping risk assets, read the S&P even more than where it should have been, based on simple flow models, and that contrary to market expectations, the S&P500 should have been about 40% lower compared to where it will be on June 30 if the Fed has pursued its stated goal, and targeted solely a 100 month average maturity.

Which has a rather scary implication for the stock market: if and when Ben announces that Twist ends on June 30 with no successor program, stocks will immediately react, and realize that the Fed's SOMA account holds well more than the expected long-end, and that without further "flow" forcing more 30 year paper into the gaping maw of Bernanke, stocks will have no reason at all to maintain their prior epic surge (all else equal, whcih (sic) it won't be).

It also means that unless Bernanke is willing to see the stock market plunge ahead of the Obama re-election, which he isn't, or at least the President most certainly isn't, that the June Fed statement will be quite interesting, as not only will Bernanke have to maintain a program which is now uncovered to have been monetizing the long-end at a rate 40% higher than estimated, but will still have just two more months of capacity left for any potential future sterilized market propping experiments.

Which only leaves the Fed with one option: that of making Bill Gross, and all those others who are loading up on duration-sensitive securities which will benefit from an LSAP based episode, very, very happy. Of course, the list of such assets most definitely includes gold.

____________________________

Edited by John R. Houk

No comments:

Post a Comment